Cancer DriveLine Financials

Fiscal Year 2021/22

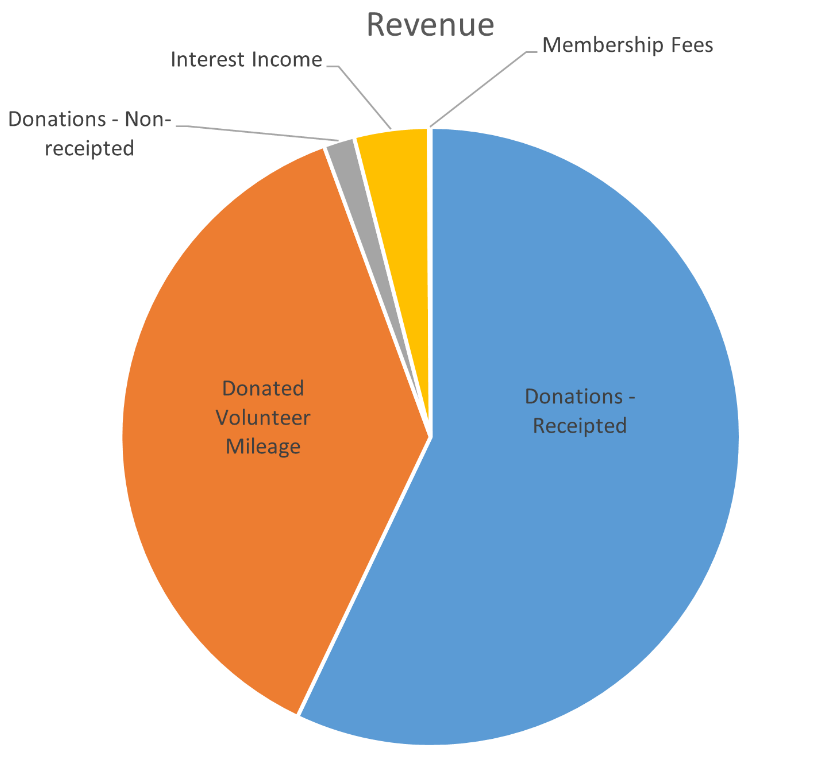

| Revenue | Amount |

|---|---|

| Donations - Receipted | 53,643 |

| Donated Volunteer Mileage | 35,096 |

| Donations - Non-receipted | 1,515 |

| Interest Income | 3,651 |

| Membership Fees | 90 |

| Total | 93,995 |

Notes about Revenue:

The audited financial statements by McAvoy Rule & Company (MRC) summarize all receipted donations into one line. We have separated it into two lines, Donations – Receipted and Donated Volunteer Mileage, to show that nearly two-thirds of the volunteer mileage expense (Program Costs) is donated back to the Society by volunteers.

Non-receipted donations include donations received from the United Way or the Provincial Employees Community Services Fund, or which were donated via Canada Helps or Canada Online Giving. Those organizations issue income tax receipts to donors and therefore the Society does not need to.

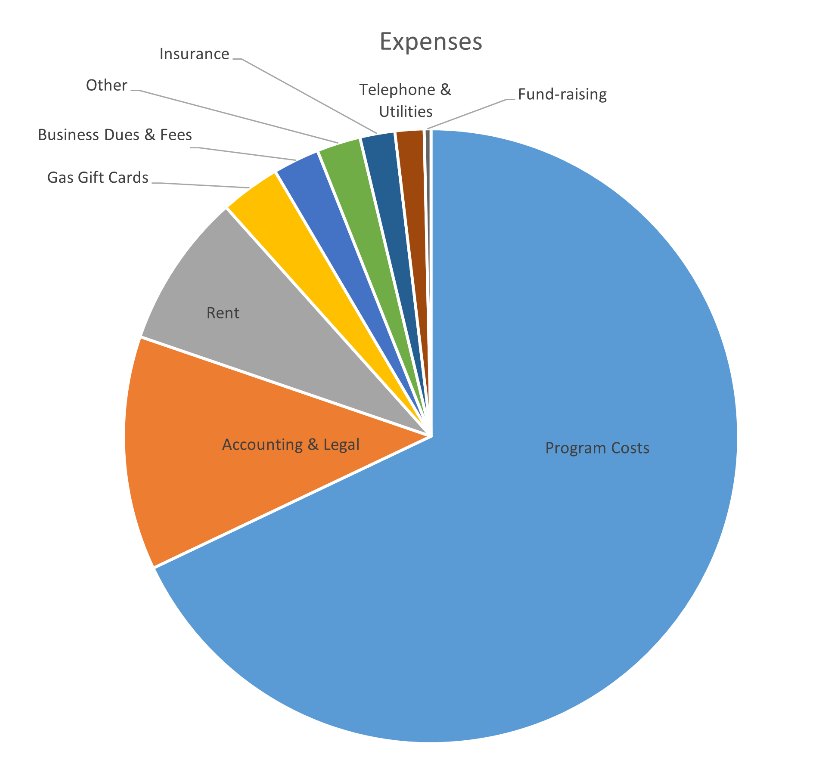

| Expenses | Amount |

|---|---|

| Program Costs | 53,909 |

| Accounting & Legal | 9,764 |

| Rent | 6,452 |

| Gas Gift Cards | 2,500 |

| Business Dues & Fees | 1,939 |

| Other | 1,827 |

| Insurance | 1,455 |

| Telephone & Utilities | 1,212 |

| Fund-raising | 283 |

| Total | 79,341 |

Notes about Expenses:

Program Costs are the mileage costs incurred by volunteers. Volunteers drove over 100,000 kilometers during fiscal year 2021/22, reimbursed at a rate of $0.46/kilometer in calendar 2021 and $0.53/kilometer in calendar 2022.

Accounting & Legal includes $9,600 for a full audit by McAvoy Rule & Company (MRC), of which $4,800 was donated by MRC as a gift-in-kind. An audit is not required and usually we do a financial review which is less rigorous and costs much less. An audit for 2021/22 was deemed appropriate by the Board of Directors as the Treasurer was coming to the end of his term in office, and both the Board and the Treasurer wanted assurance that the books had been handled correctly during his tenure.

In the MRC financial statements, the categories of advertising, gas gift cards and fund-raising are summarized in one line. We have separated out the gas gift cards and fund-raising to show that fund-raising accounts for less than one-half of 1% of expenses. Fund-raising activities include soliciting large organizations for cash or gift-in-kind donations and sending requests for donations by mail to new clients. Fund-raising expenses are limited to the costs of brochures, stamps, and envelopes.

Peninsula Co-op donated $2,500 worth of gas gift cards, which the Society gave to drivers as gifts of appreciation. In the MRC financial statements, the gas gift cards are included in both revenue and expenses: in revenue as Donations – Receipted, and in expenses as Advertising.

For the sake of simplifying the pie chart, Advertising, Amortization, Bank Charges & Interest, and Office Supplies are summarized as Other in a single line. The amounts for each of these line items can be found in the MRC financial statements.